|

sip |

1,35,000 |

|

invest in sip |

27,100 |

|

calculate sip returns |

40,500 |

We all have financial goals in life such as buying a car, house, retirement planning, child’s higher education, foreign trips and many more. In order to give wings to these dreams, one needs to not only save money but also invest it further for making it grow in the future. If money is left idle, it does not multiply and this is a mistake most investors tend to do.

Some are apprehensive of setting foot in the world of investments, some are unaware, whereas some tend to withdraw the money only after a short term when they see the markets falling. There will be different investors with different goals and risk taking appetite, but the central idea here is to start investing and let it grow over the long term for building a substantial corpus. For facilitating this, one can invest in SIP.

A SIP is a mode of investing in mutual funds in which investors can make regular contributions for the period chosen. One can do this by determining the goal target amount and the investments required to achieve that goal during the time period chosen through SIP mutual funds.

For instance, if you would like to invest even Rs 500 monthly for 5 years, you can set up a SIP account with a mutual fund company and automate payment of your SIP instalments. You can invest any amount through SIP. Typically, SIP mutual fund allow investing frequency of weekly, monthly, quarterly and half-yearly, but the most popular option is monthly. While a salaried person may find monthly frequency ideal, a businessman may like it to be weekly or daily as he might have regular cash flows.

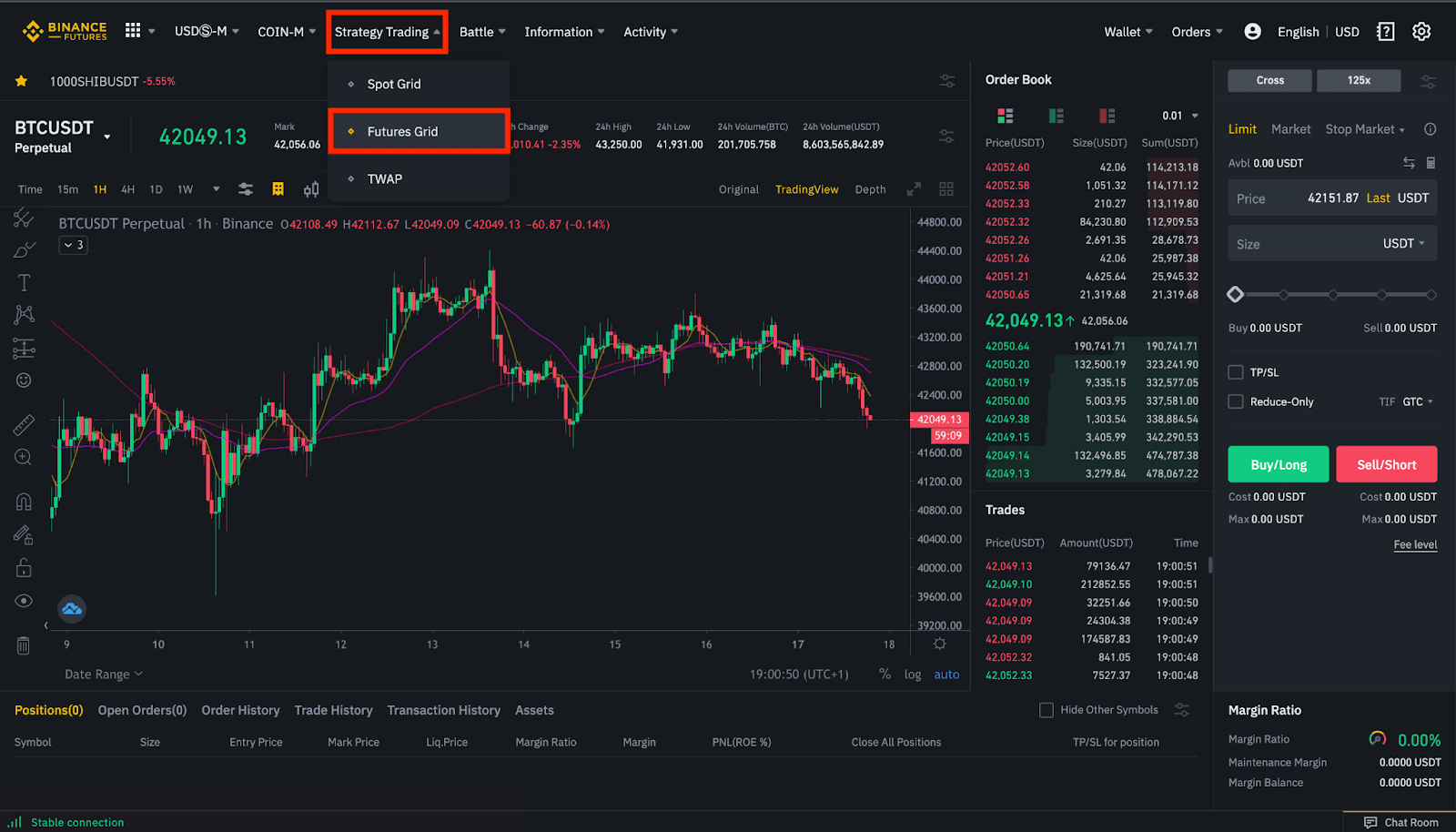

Now, to calculate SIP returns, one can use tools available online such as SIP calculator. Goal planning involves number crunching like the goal amount, period and the expected returns. SIP calculator can estimate potential future returns based on the above assumptions. The SIP return calculator takes into account the goal amount, time period and the assumed rate of returns, based on that it tells you the monthly SIP amount with which you can start investing.

However, if you do not have any goal in mind, you can simply input the monthly SIP amount, SIP period and the assumed return rate of return and the SIP calculator will show the future corpus amount.

In order to invest in SIP, one needs to be KYC compliant as per SEBI guidelines. Through KYC, the identity and address proof of the client is verified. Once the KYC is done, the SIP can be started immediately. If you wish, you can also invest in SIP online. Starting a SIP mutual fund investment is a fast and easy process that one can follow and get themselves started with investing for their goals.

SIP happens to be a customisable method to invest in mutual funds. You can start investment in mutual fund schemes which is suitable to your risk appetite and investment time period. You must use a SIP calculator in order to plan your goals and / or to know the future value of your SIP mutual fund.